“Modern technology has become a total phenomenon for civilization, the defining force of a new social order in which efficiency is no longer an option but a necessity imposed on all human activity.” Jacques Ellul (Professor & Sociologist)

Frank William Abagnale Jr. is one of the most infamous legends who started conning people at 15. The book and movie ‘Catch Me If You Can’ immortalize his story. He donned on the identity of a pilot, attorney, and doctor, among others, and forged checks to swindle money over the years. During Frank’s time as a con artist in the 1950s-1970s, neither the conman nor the law enforcement had the modern technology to their advantage. However, today, technology can save your time and effort while investigating forged and bad checks.

Even though check usage is declining due to online banking and debit/credit cards, financial fraud through forged and bad checks remains a prominent method of scamming victims. The deposit account fraud survey published by the American Bankers Association in 2020 revealed that in 2018, check fraud accounted for 47 percent or $1.3 billion of the industry’s deposit account fraud losses. One such recent check fraud case is the felony lane gang conspiracy, where the authorities have charged nine men in a thirteen count indictment for their roles in the scheme.

Felony Lane Gang Conspiracy

Tyrone Parker from Florida recently pled guilty for his involvement in a fraud scheme known as the ‘Felony Lane Gang Conspiracy’ between July 2019 and September 2020. Parker and his co-conspirators traveled across the country, targeting the cars parked by women drivers and committing ‘smash-and-grab’ vehicle thefts. They stole the victims’ debit cards, credit cards, photo identification, and checkbooks and recruited women to impersonate the victims to cash checks. The recruited women often suffered from drug addictions and were compensated with narcotics. Parker admitted that the loss amount from the conspiracy attributable to him is between $95,000 and $150,000 over 15 months.

The felony lane gang conspiracy is a case with the financial data consisting of forged checks of numerous victims holding accounts in various banks and other related documents like bank statements. A scheme cleverly devised by Parker and eight other men to dupe different women can be challenging to investigate, considering the number of forged checks deposited in various banks and the supporting financial documents.

Investigating the Check Fraud Cases

As you are aware, investigating check fraud cases, especially with many checks, can be daunting. The financial data in large check frauds also consist of supporting documents like bank statements, deposit slips, etc. The data preparation and collation can take days and months. Handwritten checks can also be sometimes hard to decipher. It would help if you had an easy way to convert the check images to Excel to get on with your job of investigating the case.

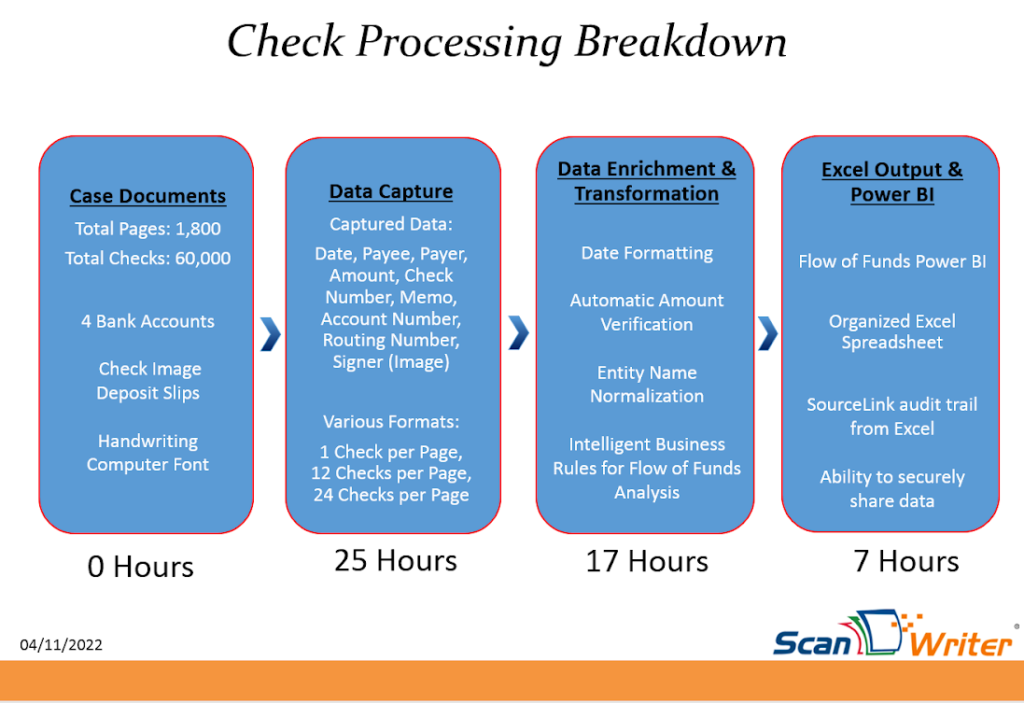

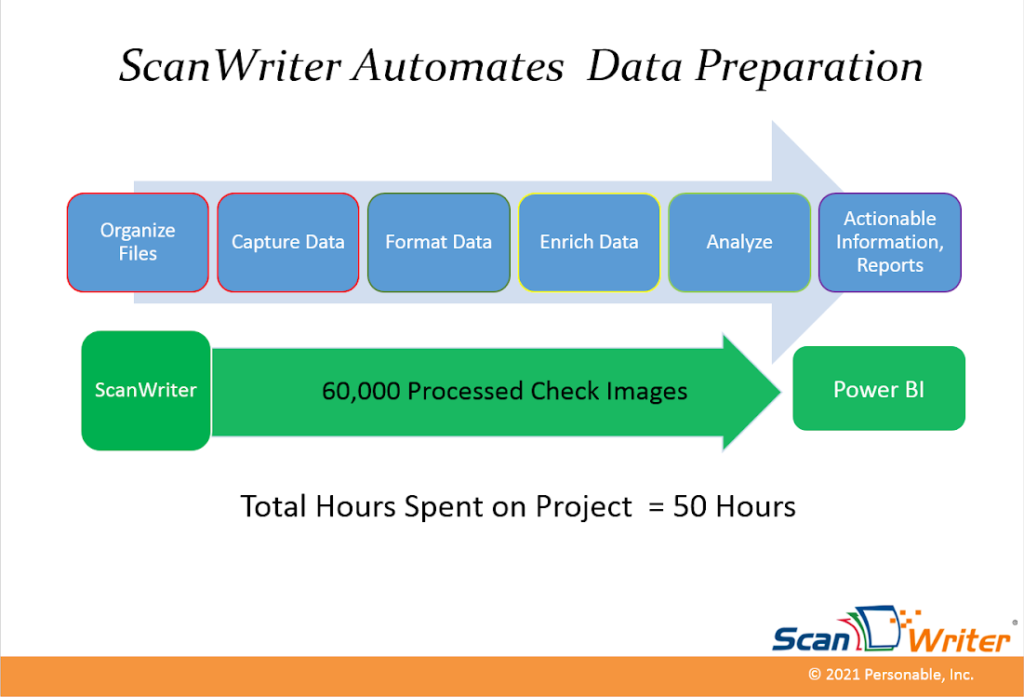

Modern technology today allows you to automate the data capture and analysis effort. The tasks that manually take days to complete can be accomplished within a few hours with the help of digital tools. One such tool is ScanWriter which can easily capture, convert, enrich, and analyze data. Here is an example of how ScanWriter can reduce the time to process numerous checks from four different banks within hours.

ScanWriter

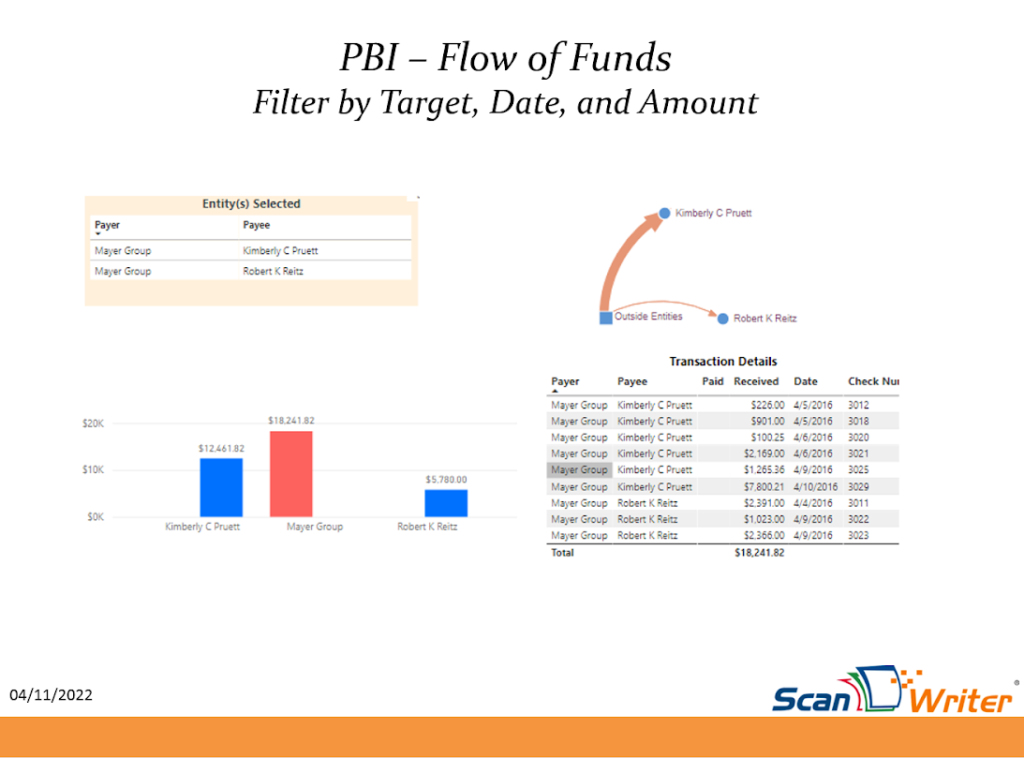

ScanWriter by Personable Inc. is a digital tool to convert any paper document or digital file, including check images, bank statements, bills, invoices, receipts, phone records, insurance forms, and other such documents, into Excel. In partnership with Microsoft Power BI (Business Intelligence), it automatically creates financial data visualizations like the ‘flow of funds’.

You can manage the high volume and batch processing of checks with ScanWriter. It supports 21 languages, and you can find more than 40,000 institutions in its library, including over 10,000 financial institutions. It has a user-friendly interface and easily integrates with your existing processes. ScanWriter is a quick and efficient way of data preparation that allows you to focus on the more critical tasks in the financial fraud investigation. For example, it takes approximately 50 hours to process and analyze 60,000 checks.

Easy Capture of Check Image Data

ScanWriter instantly captures check image data from any format. It can process a single check per page or 12 or 24 checks per page. It quickly reads both printed and handwritten data on the checks. ScanWriter can automatically collect the following fields from each check:

- Payee

- Payer

- Check number

- Date

- Amount

- Memo

- Signature (image)

- Magnetic Ink Character Recognition (MICR) font (routing and account number)

Accuracy

ScanWriter ensures 100% accuracy of the converted data and also allows for easy verification with the original document. With the option of check the balance in the data preparation screen, you can quickly reconcile the entries from the actual checks. ScanWriter’s intelligent error detection tools ensure accuracy and maximize your data entry efficiency.

Audit Trail

ScanWriter uses advanced forensic accounting tools to link Excel cells to data sources and highlight the data origin locations. It allows you to follow the flow of funds and track the money trail.

Data Analysis & Visualization

ScanWriter with Power BI can segregate the data by target, date, amount, etc., and gives you an analytic summary of the data within minutes. You can visually create different kinds of financial models as per your requirements. ScanWriter also has pre-created financial models integrated into it, so you can choose one of these and create powerful visualizations. The data analysis also helps flag the potential signs of check-kiting by providing unusual patterns like similar deposit and withdrawal amounts in even numbers.

Data Confidentiality

ScanWriter maintains the confidentiality of the data by saving it locally. It is an on-premise software that allows you to maintain the integrity of your financial data. You can also verify the data with the check on the data preparation screen.

Takeaway

Check frauds are usually complex schemes. Especially in conspiracies like the felony lane gang conspiracy, compiling and analyzing the data can be cumbersome. ScanWriter can automate the data preparation and analysis to make your job easier. It cuts the hourly labor cost by 90% and allows investigators and enforcement agencies to concentrate on more critical tasks. ScanWriter links Excel cells to data sources and highlights the data origin location, allowing you to recognize money flow. It reduces the need for multiple checkpoints to account for human error and has a user-friendly interface. To gain more insights into the working of ScanWriter, read this case study, where an Investigator at the District Attorney’s office had to investigate a large embezzlement case involving a sophisticated web of money transfers and wire fraud, including over 100,000 checks. ScanWriter helped the investigator save at least nine months’ worth of work.